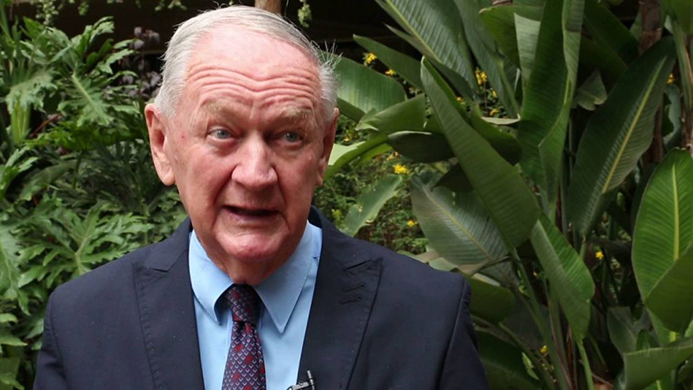

by Eddie Cross

IT IS not possible to predict what is likely to happen this year and anyone who tries to do so is almost certain to be proved wrong. But what we can do with a measure of confidence is to put on the table an agenda of items that we will need to tackle as a country as we strive to go forward.

In my view, the reform process in Zimbabwe has been put in neutral over the past year. This is even though the country has responded so strongly to what has been achieved in the past four years. We need to understand that time stands still for no one and if we want to continue making progress in our struggle to lift our people out of poverty, then we must commit ourselves to further reform.

President (Emmerson Mnangagwa recently) made two significant decisions which I think we should all welcome and support. The first was to confirm the decision by the government that they were going to grant freehold title to the hundreds of thousands of new homes which have been built on State land since 2005 for a variety of reasons, which we don’t need to detail here.

The government has allowed people to buy pieces of land from so-called land barons and on the strength of simply a receipt for the money paid, they have gone ahead and built homes on the land in question. I got a couple of graduate students to sit down with Google Earth and to try and count the number of homes built in this way in urban areas across the country. Our conclusion was that they could reach 1,5 million homes.

By extending freehold title to these households in Zimbabwe, we will be creating wealth on a massive scale and all that new wealth will be controlled by the families who own the properties involved. The majority have been funded by the diaspora, but it is their local families who will benefit from the actions being taken by the government.

For me this decision stands alongside the decision taken by Margaret Thatcher when she was Prime Minister of Britain, to sell state owned housing to the people who had rented it nearly all their lives. This decision changed the lives of millions of people, and I would expect no less in Zimbabwe.

The second decision which the president announced was his willingness to look at what we might do as a country to heal the wounds of 37 years under the dictatorship of Robert Gabriel Mugabe. The best known of these was the Gukurahundi campaign from 1983 to 1987 when tens of thousands of people were murdered by State agents in the south and west of the country and well over one million people were forced to flee the country for South Africa. But it did not stop there, and in subsequent national programmes such as Murambatsvina, the State continued to violate individual rights and in fact create conditions under which millions of people died prematurely.

The nurse who cared for me last week while I was ill with Covid-19 came from the Tsholotsho District of Matabeleland and we talked at length about her experiences during Gukurahundi. Anyone who has had such conversations will know that the wounds of that run deep and are as real today as they were 30 years ago. We need to bury our past and to seek reconciliation and forgiveness for what we have done to each other in our race to nationhood. The president has opened the door to this process, and it is up to the community to respond.

We are now just 18 months away from next elections and we must all recognise that we cannot rest on our laurels. The 2018 election was probably the most representative since Independence and its outcome unchallenged, but it was not enough. We need to take steps to make sure that when we go to the polls in 2023 that the outcome cannot be challenged by anyone. That is a tall order and will need action across many different fronts.

But the main order of business which confronts us as a nation and the Finance minister in particular, is the question of how to manage our foreign exchange market. During the past three years we have made enormous progress in this respect. We have a market which operates on a weekly basis, and which produces an exchange rate which now finds wide acceptance by businessmen throughout the country, and which has laid the foundation for a recovery of the productive sector in Zimbabwe. But we have failed to meet demand for hard currency on the auction and delays in settlement together with the accompanying cash flow problems for companies have undermined the benefits of the new system.

The minister’s problem is that nobody wants change. Everybody recognises that the informal sector rate which seems to dominate domestic retail prices is completely unjustified and does not represent the real value of the local currency in any respect.

While acknowledging all of this, I do not know of a single businessman or a bank which would support the strong medicine which is needed to cure this malady. I am afraid that the minister is going to have to tackle this thing on his own and I trust that when he does that the president will see the need for the measures he must take in order to put the Zimbabwean economy back on a path which is sustainable and self-supporting into the future.

Cross is an economist and former legislator.

See full opinion on Website

In my view this is the only issue on the table for the Ministry of Finance in 2022. Zimbabwe continues to pursue policies in respect to foreign exchange management which represent an aberration in the context of global practice. Even in countries that are desperately poor and bear no resemblance to the Zimbabwean economy, their authorities have been able, over the past decade, to introduce policies which have established a normal foreign exchange market and created the conditions for an acceptable exchange rate.

The exchange rate is probably the most important single pricing mechanism in any given economy. No matter how large or how sophisticated, countries must manage their exchange rate to keep their economies stable and growing. In December 2021 our inflation rate for the month was once again just over five percent. In the Zimbabwe context this looks remarkably good, but it is far too high a rate of inflation to really ensure price stability going forward. We have created the conditions for the introduction of a more normal exchange rate management system and the time has passed when we can consider any possible alternative course of action.

If we want to collapse the informal sector rate and we want to get our inflation down to more acceptable levels, then we simply must take the measures that are now necessary.

Cross is an economist and former legislator.